What is Opportunity Cost? Definition, Formula and Calculation

June 10, 2021 Max 6min read

What is Opportunity Cost?

Opportunity Cost Definition

The value of what you lose when choosing between two or more possibilities is opportunity cost. When you decide, you believe that the outcome will be beneficial for you, irrespective of what you will lose by doing so.

Opportunity cost in economics refers to the loss of potential gain for an individual, investor, or business when they choose one alternative over the other.

Analyzing and understanding a missed opportunity lost due to a particular investment over another leads a person to better decision-making.

Opportunity cost can be measured in either time or money. If one is not careful, these opportunity costs can be overlooked, which may not result in any immediate losses. But can stack up and be a long-term disaster.

Choosing one option over the other — whether in terms of time, money, effort, or utility – is opportunity cost. Without thinking about all these aspects, we make these decisions.

Before making a purchase, we examine various elements. Avoiding the opportunity cost throughout the prioritization process of product roadmap software might result in inefficient decision-making.

As we make several decisions every day, our brain saves prior decisions and uses them to speed up decision-making. Time, effort, and money are all things that our brains consider simultaneously. This allows us to make a selection that maximizes how much each of these criteria is valued.

We have understood the opportunity cost definition, and time to look at its types.

What Are the Types of Opportunity Cost?

There exist two distinct types of opportunity cost. Below, we shall delve into their respective definitions.

Explicit Cost

Explicit costs are direct and measurable payments such as purchasing stocks, spending money on rental properties, or paying wages, utilities, materials, or rent. For example, suppose you own a restaurant and add a new menu item that costs $50 in labor, ingredients, electricity, and water. In that case, your explicit cost is $50. The opportunity cost is the potential benefit or profit you could have gained if you chose an alternative option.

Implicit Cost

Implicit costs are not directly measurable and do not involve financial payments. They represent the opportunity cost of choosing one option over another and the lost opportunity to generate income from resources. For instance, if you have a vacation home for personal purposes, the implicit cost is the rental income you could have earned if you leased the property instead of using it yourself.

Explicit and implicit costs are essential for decision-makers since they help identify the trade-offs involved in making choices. Explicit costs are typically easier to calculate, while implicit costs can be more challenging to identify since they are often intangible and indirect. Understanding both types of opportunity costs is crucial in making informed decisions considering all available options and their associated costs.

Examples of Opportunity Cost

To have a solid grasp of the concept, we will look at a few opportunity cost examples.

Let us say you get a surprise windfall of $5000. You decide to spend it all on a getaway trip. Wouldn’t that be great? If you think of Opportunity cost, there is no loss.

So, you do not go on your getaway trip. Instead, you invest your money somewhere else, paying 3% interest compounded yearly.

In 10 years, that investment would grow to $6719. If you want to understand the opportunity cost, that $1719 is it.

In his high school days, a baseball player decided to train for an extra month instead of taking a vacation and relaxing. The opportunity cost was the vacation.

Another example would be a college student who studies for a test, instead of going out and partying with their friends on the weekend. The opportunity cost was the party and the fun that they gave up.

An opportunity cost might sound intimidating due to its name, but it isn’t.

Sometimes, a small cost in time, money, or entertainment could reap huge dividends.

How Opportunity Cost Works

Let’s say you have $5,000 and are trying to decide whether to invest it in Stock A or B. Stock A is currently worth $50 per share, and you can buy 100 shares, while Stock B is presently worth $100 per share, and you can buy 50 shares.

The opportunity cost of investing in Stock B is the potential return you could have gotten from investing in Stock A instead. In other words, if you invest in Stock B, you’re giving up the opportunity to invest in Stock A and any benefits or returns you could have received from it.

To make the best decision, you must consider what you value more: investing in Stock A or B. It would be best if you also weighed each option’s potential benefits and drawbacks, such as the volatility of each stock, the performance of the company, and the potential for dividends.

How to Calculate Opportunity Cost?

Opportunity cost is the benefit you forego in pursuing one path over the other.

Though there is no hard and fast mathematical formula to calculate the opportunity cost, we generally talk about opportunity cost in terms of investment. Here is a generic formula for better understanding.

Opportunity Cost Formula:

Opportunity Cost = FO – CO

FO stands for “return on best-forgone option.”

CO denotes a return to a chosen option.

For calculating opportunity cost, the difference between the expected returns of each option must be taken into account.

So one can understand it as:

Opportunity cost = ( Return on the most profitable investment – Return on your investment )

The closer this value is to 0, the better is your choice, i.e., the investment you made.

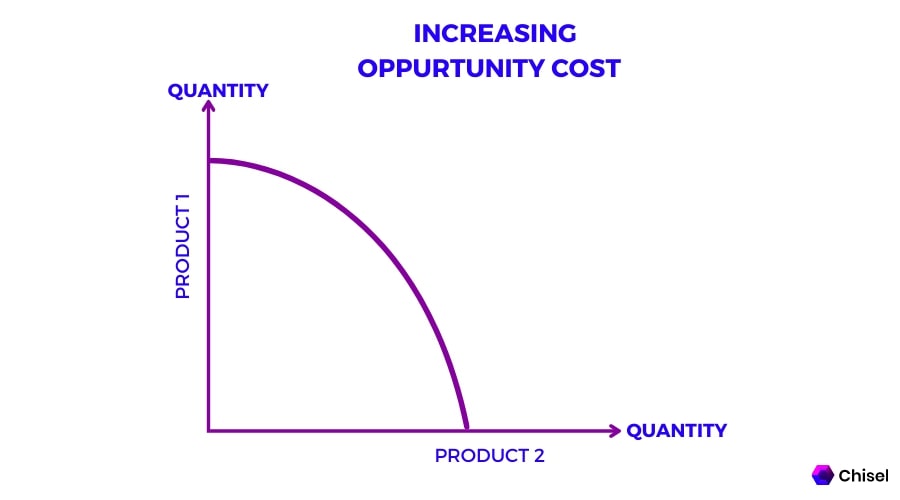

Law of Increasing Opportunity Cost

As per the law of increasing opportunity cost, a firm’s opportunity cost increases as production rises. When the manufacturing of one product increases, the opportunity cost of producing the following unit increases as well.

This arises due to the company reallocating resources to develop that product. On the other hand, the business was better off employing those resources for the intended purpose.

Every company strives to use its resources to their full potential or be as efficient as possible. Everyone will not have the same monetary resources. As a result, we must make the best decisions possible with our resources.

Economists claim that opportunity cost influences our decision-making.

When you utilize a seamless product management system like Chisel, you can decide how to allocate your resources effectively to achieve the most effective results for your business.

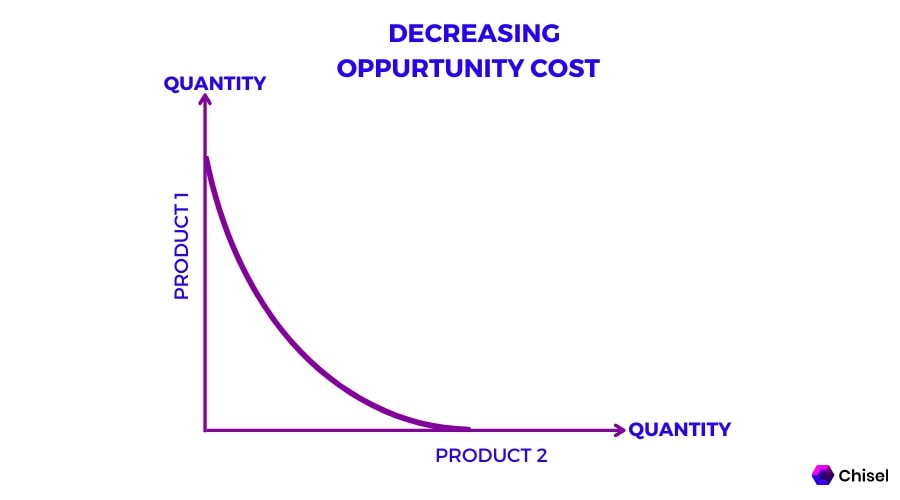

Law of Decreasing Opportunity Cost

The law of decreasing opportunity cost states that a firm’s opportunity cost reduces when production declines. When the cost of producing one product reduces, making the next unit also reduces.

In this scenario, increased production decreases the opportunity cost. While opportunity cost is reduced in specific circumstances, this is rare across the business. This would be incompatible with the assumption of technical efficiency and real-world experiences. In this situation, the company opts to produce more of one product while decreasing the amount of the other.

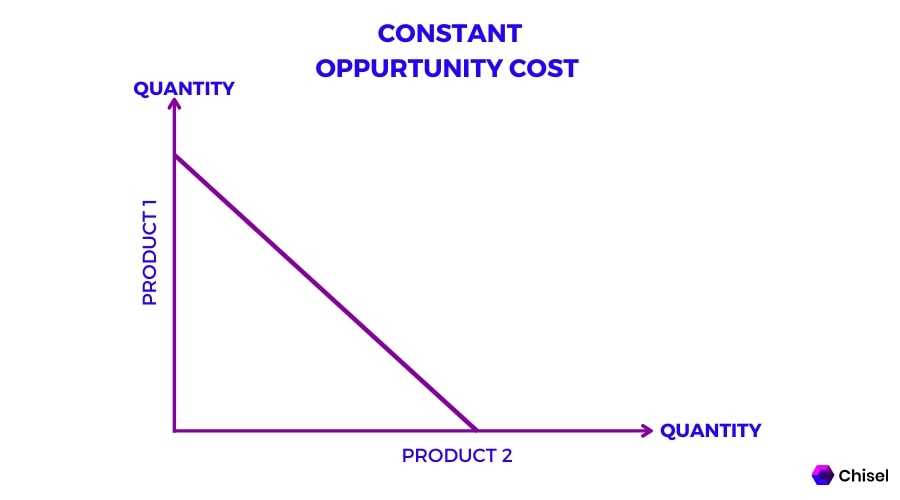

Law of Constant Opportunity Cost

Constant opportunity cost describes a scenario in which the expenses of pursuing a specific opportunity do not evolve, even though the benefits obtained from the action do. The concept is frequently used to describe a manufacturing process in which the costs of producing goods and services stay unchanged while allowing for increased output.

This usually implies that the cost of using more resources to manufacture more commodities does not translate into a lower cost per unit produced. Nor does it cost more to make each of those units.

The relationship between costs and the number of units produced remains constant when the opportunity cost is constant.

You may also be interested in:

FAQs

The concept of Opportunity cost enhances our decision-making. It helps us explore every possible option before coming to a final decision. It helps us to use every resource available to us carefully and efficiently. You cannot ignore opportunity cost in prioritizing the process of developing product roadmap software or product management software.

The law of increasing opportunity cost is an economic principle that describes how each time a resource is allocated, there is an underlying cost of using them for one purpose over another.

When you create more and more of one good while giving up more and more of another, you have increasing opportunity costs. When transitioning from the production of one good to the production of another, this happens because resources are rarely flexible. With decreasing opportunity costs, the opposite occurs.