What Are the Economies of Scale? (Definition and Examples)

October 31, 2023 Max 10min read

Table of contents:-

- What Are the Economies of Scale?

- How Do Economies of Scale Work?

- What Are the Types of Economies of Scale?

- What Are Three Sources of Economies of Scale?

- What Are the Factors That Cause Economies of Scale?

- Significance of Economies of Scale

- What Are the Benefits of Economies of Scale?

- What Are the Examples of Economies of Scale?

- Economies of Scale vs. Diseconomies of Scale

What Are the Economies of Scale?

Economies of Scale Definition

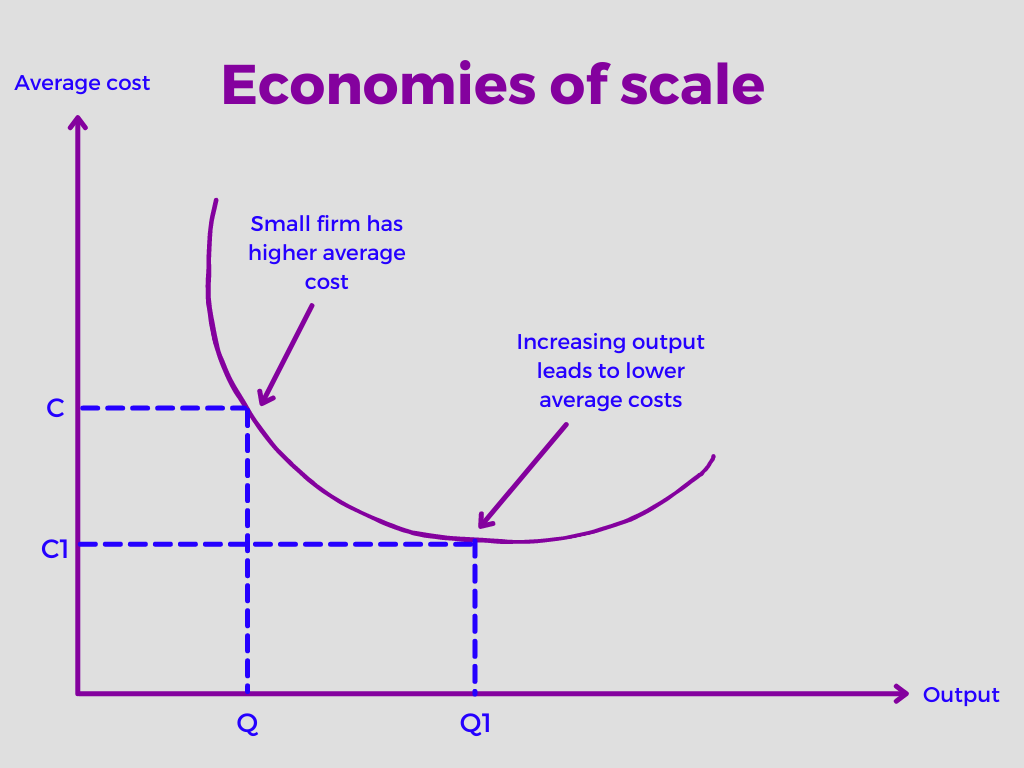

“Economies of scale refers to an increase in the magnitude of goods produced where the average cost of production decreases. In other words, the price to make an additional unit of product comes down as the company grows.”

Economies of scale are cost benefits a business gains by scaling up production. This gain is because the fixed cost incurred over increased production units gets distributed.

The per-unit cost and production quantity share an inversely proportional relationship.

For the increased production scale, purchasing the material in bulk leads to a lower per-unit price. It thus adds up to the economies of scale.

Economies of scale is a metric that reflects successful production strategies.

Bonus: To learn about product strategy in further detail, click here.

How Do Economies of Scale Work?

Achieving economies of scale is a vital part of growing a successful business. Put simply, economies of scale refer to the cost savings companies can realize by increasing the size and scale of their operations.

One of the main drivers is spreading fixed costs over more units of output. Office rent, equipment, and staff salaries stay the same regardless of production levels. But when you increase your production volume, those fixed expenses get allocated to more products or customers. It directly brings down your average unit cost.

Larger scale operations also allow for better optimization. Specialized processes and equipment maximize efficiency, reducing waste and boosting productivity per employee. Ordering materials in bulk lets you negotiate volume discounts from suppliers, too.

For tech and other R&D-heavy industries, scaling up further spreads out development costs. Spreading marketing and distribution costs over a larger customer base has similar benefits.

Potential customers also see the advantage of working with an established provider. A proven track record helps ease concerns about reliability, support, and the long-term viability of the vendor.

Of course, there are natural limits to economies of scale. Rapid growth can introduce growing pains if operations become too complex. The key is achieving scale strategically – only expand as processes, culture, and infrastructure develop to support it efficiently.

If done right, though, economies of scale create a decisive competitive advantage. Lower average costs allow for attractively priced offers. Existing customers benefit through improved service and innovation on a more robust platform. In business, scale is often the difference between surviving and truly thriving.

Key Highlights:

- Economies of scale are cost advantages that businesses gain as a result of their size of operation.

- Production, marketing, and management economies of scale are the three primary categories of economies of scale.

- Economies of scale can have a substantial impact on a company’s profitability since they enable companies to cut costs or offer more affordable prices to their consumer base.

What Are the Types of Economies of Scale?

There are two types of economies of scale:

Internal Economies of Scale

Internal economies of scale are unique to each organization and are associated with large businesses.

For instance, major companies can reduce the cost per unit by buying raw materials in bulk for large-scale production. You can charge lower rates to customers due to the cost savings. The cost savings may get passed on to customers through lower prices, or they can reinvest in the company to enhance products and services. Both of these are examples of internal economies of scale.

Measuring a company’s production efficiency often comes down to looking at its internal economies of scale. As the company ramps up production and makes more products, the average cost per item decreases. This results from the company’s growing size and is something their management team can influence. The specific factors that affect a company’s internal economies of scale are unique to that business and independent of the industry they’re in.

There are a few different types of internal economies of scale. Technical economies come from using bigger, more advanced machines or streamlined production processes. A classic example is Henry Ford’s assembly line model, which sped up vehicle manufacturing significantly.

Internal economies generally allow companies to maximize efficiency as they scale up. Management is crucial in identifying opportunities to reduce average costs through technical improvements, bulk purchasing, or cost management strategies over time.

External Economies of Scale

External economies of scale arise when factors outside a company’s control help reduce costs across an entire industry. It can happen due to developing a skilled local workforce, suppliers building strong relationships, and government assistance programs.

For instance, you see external economies at play in the oil industry through historical subsidies from the US government. The subsidies worked to lower costs for all oil producers.

External economies can significantly impact an industry’s competitiveness. Companies that capitalize on them through their location or other advantages may produce goods and services more cheaply than rivals. It allows for lower consumer prices and higher profits versus competitors without the same access to external scale advantages.

What Are Three Sources of Economies of Scale?

The three sources of gain in costs through economies of scale are the following categories:

Purchasing

Bulk purchasing can lower the per-unit cost of raw materials, saving costs through scaled-up production. Firms can reduce average costs by buying inputs in bulk from specialized wholesalers or negotiating volume discounts with suppliers. It takes advantage of economies of scale, where the cost per unit decreases as the volume of production increases.

Managerial

Improved managerial structure can lead to better cost management and savings. Firms can lower average costs by improving their internal management. It may involve hiring more skilled or experienced managers or restructuring the organization in a way that is more efficient and effective.

Technological

Technological advancements can drastically change the production process. Still, only large firms that can invest in new technologies can typically take advantage of these changes.

For example, fracking revolutionized the oil industry a few years ago. Still, only large oil companies could afford the expensive equipment required. Cost-effective technologies, on the other hand, can reduce production costs and scale up production for all firms, regardless of size.

What Are the Factors That Cause Economies of Scale?

The four major factors that cause economies of scale are as follows:

Specialized Labor:

Firms that are growing will focus on employing trained laborers. This way, firms can divide the tasks and allocate them to experienced workers.

The cost of hiring trained workers can be high, but the results outweigh the cost incurred.

Skilled laborers can finish more work with fewer people, which helps reduce cash and production costs.

Having specialized workers in your team will boost economies of scale because you can produce more goods in less time.

That way, workers will also have time to discuss how to improve production.

Impact of Capital and Technology:

Capital refers to the financial resources a firm has available to them to improve its operations.

Then, these firms can efficiently use the money to experience economies of scale. Firms can buy machines that can help with increasing production capacity.

And when utilized at the highest capacity, these machines can lower per-unit production costs.

Technology can help companies commit fewer errors and increase the production process. Some of the modern technological items companies use are:

- Computers

- Software

- Robotic equipment

- Internet

Another benefit of having efficient capital is that these firms do not have to focus on generating cash but pay more attention to operations.

Cheap Materials Due to Power of Negotiation:

Companies collaborate with other parties like the government, financial institutions, unions, vendors, and suppliers.

Experienced firms are in a better position to negotiate when purchasing raw materials. They can deal and get discounts by purchasing raw materials in bulk. This way, the material cost during production decreases.

Since workers are ready to work for minimum wage in large companies, the firms can also negotiate there.

Banks and other financial institutions will be more willing to give loans to a large firm, which acts as economies of scale.

Learning Lessons:

A well-established firm has an efficient structure and production process in place. That helps them to learn and grow with experience. Large firms have better access to conduct research and bear the costs than young firms.

Research can help them learn better ways to produce goods and use formulas that will help lower the cost of production per unit. They also conduct user research to understand their target audience’s needs better.

Chisel- a primary app for product managers, gives you a space to collect customer feedback and enhance your products.

Significance of Economies of Scale

Economies of scale is a handy metric as it can support your production and sales strategy by indicating the best phase to scale up the production.

Economies of scale also help in cost management. Calculating the economies of scale provides important information about approaching and managing production to gain the most cost benefits.

The data of economies of scale answers when you should scale up and to what extent.

You can use the economies of scale formula to determine the cost with a change in output. Cost elasticity or cost output elasticity is the formula mainly used to calculate the economies of scale. Your firm enjoys economies of scale if the value is less than one.

The economies of scale formula:

Cost of elasticity = % change in total costs / % change in output

You can also use the economies of scale formula excel to calculate the economies of scale in the excel sheet.

Bonus: Click here to check an excellent article about product cost that might help you immensely.

What Are the Benefits of Economies of Scale?

Benefits of Economies of Scale to the Firms Are:

- Global Competitiveness: Lower per-unit costs allow you to price products and services competitively in domestic and international markets.

- Profitability and Investment Returns: Reduced costs increase potential profit margins per unit sold. Higher profits provide more capital for reinvesting in the business to fuel further economies of scale.

- Room for Expansion: Cost savings free up funds that can help to enter new markets, develop new products/services, or invest in research and development.

- Reduced Competitive Threats: Companies with economies of scale can offer competitive prices while maintaining margins, making it tough for smaller rivals to compete.

- Stability and Sustainability: Lower costs buffer against economic downturns or disruptive industry changes.

- Resource Efficiency and Innovation: Firms can allocate funds more efficiently with lower costs. More funds can support research and innovation.

- Customer Benefits: Companies may pass on some cost savings to customers through lower prices, boosting loyalty and attracting new customers.

Some of the Benefits of Economies of Scale for Customers Are:

- Product Improvements: Cost savings from economies of scale give companies funds to invest in research and development. It leads to innovations and improvements in what they offer.

- Higher Wages and Profit Sharing: Sometimes, when a business benefits from scale, profits increase. Some share this wealth with employees through higher pay, bonuses, or profit-sharing plans.

- Increased Access: Lower prices from scale make essentials like healthcare, education, and necessities available to more people by making them affordable. Accessibility is crucial for these items.

- Economic Growth Stimulation: As affordable options give people more purchasing power, economic activity increases. Overall, this contributes to economic growth.

What Are the Examples of Economies of Scale?

To begin with the example of economies of scale, we could say that an XYZ company bought an airplane worth $25 million.

If they have only one passenger, they charge them $25 to receive the costs incurred during production. On the other hand, if they get a million passengers, their rate would be only $20.

Now let’s look at the example of economies of scale, considering the two types of economies of scale.

Internal Economies of Scale Example:

Financial institutions will offer loans to well-established firms. A young local store or market is at risk of failing compared to a Starbucks or Mcdonald’s.

Apple has various design, software, production, and assembly departments. Hence, there is a division of labor.

External Economies of Scale Example:

An example of the external economies of scale is when surrounding companies benefit from well-established firms.

Silicon Valley is an excellent example of economies of scale. Neighboring firms can enjoy the extensive infrastructure and other benefits.

Coca-cola collaborates with bottle companies near the factory. This way, both the company and the suppliers can benefit from the cheaper costs of the raw materials.

Economies of Scale vs. Diseconomies of Scale

Economies of scale refer to the concept that suggests a company greatly benefits when the volume of production increases.

The average cost of production goes down too.

And some factors cause economies of scale:

- Firms buy in bulk

- Efficiency in capital and production

- Expansion in risk

- Lower storage and transportation costs

Diseconomies of scale refer to the opposite phenomenon of the economies of scale. It is a phenomenon where an additional item produced costs more even as the company grows.

The businesses that are growing will notice diseconomies of scale due to:

- No to less communication between teams

- Bad leaders and management

- Overwhelmed workers and managers as the company are growing very quickly

- Not handling change very well

- No sense of direction

Product management software like Chisel helps you in seamless team alignment.

An example of diseconomies of scale could be when a company introduces new technology.

It will require time for training and getting used to this new tech.

Suppose a department has to switch from handwritten bookkeeping to using excel sheets. In that case, they will require more time to understand and train the workers to understand the concept of computers and excel sheets.

FAQs

Suppose an increase in output results in a decrease in the per-unit cost of raw materials. In such a case, it gives a gain in price to the firm. That is called economies of scale. Cost elasticity value also indicates the existence of economies of scale. If the cost elasticity ratio is less than one, economies of scale exist.

It refers to the overgrowth of a company by economies of scale. These cost disadvantages attribute to scaling up the production and increasing per-unit cost. It is the stage beyond the saturation of economies of scale due to uncontrolled production.

A scenario that best describes economies of scale would be as follows:

Two companies with similar interests can merge and benefit from having a single office headquarters. For example, when media channels AOL and Time Warner came together, they witnessed economies of scale.

Although economies of scale provide numerous benefits, they also have certain drawbacks, such as an inadequate level of adaptability and the potential for excessive bureaucracy.

A semiconductor manufacturer is an example of a company that benefits from economies of scale. As the business produces more chips, it can negotiate reduced raw materials and specialized equipment pricing. It can also invest in more efficient production processes that result in lower unit costs, giving the company a competitive advantage.