What is Product Cost & How to Calculate it? (With Examples)

July 8, 2022 Max 5min read

Product Cost Definition:

A product cost is an expense capitalized as inventory when it gets incurred to manufacture a product. In other words, these costs are required to make a finished good and are capitalized on the balance sheet since they will benefit the company in the future.

What is Product Cost?

Product costs are the expenses incurred in the production of a product. Materials, labor, production supplies, and factory overhead are all included in these prices.

A product cost includes the labor costs associated with providing a service to a consumer. There are different types of Product pricing

Compensation, payroll taxes, and employee benefits should all be included in service product costs.

Because it comprises the production overhead required by GAAP and IFRS, product cost appears in the financial statements.

Managers may change product costs to remove the overhead component when making short-term production and sale-price decisions.

Managers may also want to concentrate on a product’s impact on a bottleneck activity. It means they are primarily concerned with the product’s direct materials cost and the time it spends in the bottleneck.

How to calculate product cost?

Direct Labor + Direct Material + Factory Overheads = Product Cost Formula

Indirect Labor + Indirect Material + Other Factory OH = factory OH

However, it is usually preferable to compute this cost per unit because it might aid in determining the right finished product sales price.

Divide the cost as stated above by the number of units produced to arrive at a per-unit cost.

Cost per unit of the product (Total Product Cost) / Number of Units Produced = Product Cost per Unit Formula.

To prevent losses, the sales cost must be equivalent to or greater than the product cost per unit.

If the sale price is the same as the cost per unit, it is a break-even position, meaning there is no profit or loss.

The selling price is now higher compared to costs per unit, resulting in profits.

What are product costs examples?

- Company A is a table manufacturer. The following items may get included in its product costs:

The cost of the wood used to make the tables (direct material).

Wages and perks for the carpenters who built the tables are direct labor.

- The price of nails used to hold the tables together as a manufacturing overhead (indirect material).

- Manufacturing overhead (indirect labor): The expense of the security guards’ pay and benefits of watching over the manufacturing site.

- The expense of plant utilities.

- Manufacturing overhead (other).

1,000 tables got created by Company A. The company spent the following to make 1,000 tables:

Wood costs $12,000.

To keep an eye on the factory, $2,000 on carpenters’ wages and $500 on security guards’ salaries.

- A package of nails to hold the tables together costs $100.

$500 for rent and utilities at the factory

$12,000 (direct material) + $2,000 (direct labour) + $100 (indirect material) + $500 (indirect labour) + $500 (other costs) = $15,100. The company’s per-unit cost is $15.10 ($15,100 / 1,000 = $15.10) because this is the cost of producing 1,000 tables.

How much should my product cost?

Price your products in line with the market:

Examining sellers in your niche is a straightforward approach to ensure your pricing is fair to you (and other artists). Find 3-5 people selling similar things to yours and determine the average price.

This can give you a notion of where you might price your product created by using product management tools. But you should not use it to set your ultimate price. This is only the beginning.

Your products should be priced based on your manufacturing costs:

How much would it cost you to manufacture your products? Include all materials, such as raw materials or ingredients, hangtags, labels, packaging, taxes and levies, shipping expenses (the cost of having the goods transported to you from the manufacturer), and so on.

Variable costs are a term used to describe these expenses. There are also fixed costs, such as rent, utilities, storage, and so on.

It is better not to include your fixed costs in your pricing. Instead, in step 4, these will get immediately added.

Set your prices based on your labor costs:

You are not compensating for your labor expenditures if your price solely covers material costs.

Do you devote any of your time to the creation of your goods? How long do you think each product will take you to manufacture, and how much do you want to get paid per hour? Do you like to be paid $20 or $200 per hour?

This is dependent on your knowledge and experience, the originality of your product, and the product’s details.

A pair of earrings may take 5 minutes to produce, but knitting a baby blanket may take 5 hours.

Your time should undoubtedly be taken into account and factored into your cost.

If an hourly rate isn’t what you’re looking for, consider how much money you’d like to pay yourself per month (or year) instead of an hourly rate.

Pricing should depend on your business strategy:

Do you wish to sell your products exclusively through your e-commerce website? Or do you want to resell them to other retailers?

Do you plan to work with wholesalers and distributors? Will you hire a fulfillment house, or will you transport your products yourself? All of these questions should get considered when establishing your final price.

Remember that, on top of storage and packing expenses, distributors and wholesalers take 10-15%, and fulfillment houses charge a set fee plus a percentage for each shipment.

How to optimize Product Cost?

Streamline your procedures:

Rather than focusing solely on production costs, you should check the complete manufacturing process.

Focusing on the process rather than product or product-related expenses is an initial significant divergence from conventional practice for many firms. Examining overall processes enables you to control the entire workflow rather than just a portion.

Another is to avoid partial process optimization or the risk of enhancing part of a process while causing damage.

Reduce your material expenditures:

Cutting down on material prices is one of the most obvious ways to save money on production. It’s usual for startup producers to select product components without fully comprehending the financial ramifications, resulting in material cost overruns later.

Consider lowering your raw material prices by adjusting the design of your product(s) and looking for less expensive alternatives.

Boost employee productivity:

Your workforce is perhaps your most valuable asset, but they’re also costly.

Look for ways for your team to function more efficiently without sacrificing accuracy. You may encourage productivity by implementing programs like:

Responsibility for effectiveness – increasing productivity through active performance management.

Incentives — bonuses to employees may still be less expensive than paying overtime and other staff expenses.

More efficient work schedules:

Think about how much it costs to keep inventory on hand:

Keeping inventory for an extended period – whether completed goods or raw resources – may quickly add up.

Consider your inventory carrying costs as a manufacturer, including storage, insurance, maintenance, and, if necessary, disposal.

A well-designed manufacturing process can avoid overproduction and excess storage costs.

FAQs

Direct material, direct labor, and manufacturing overhead are the three primary categories of product costs.

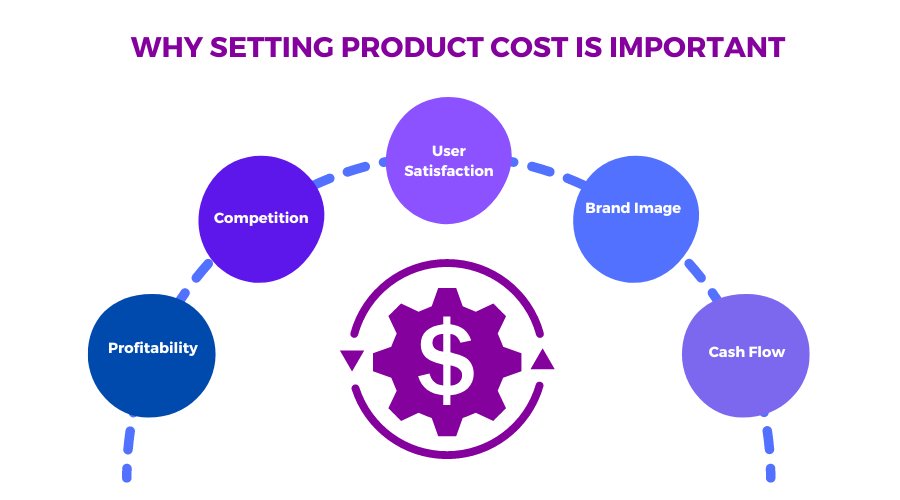

Knowing the cost of a product is critical to the business since it must manage its costs to remain profitable. It would be best if you made many sales decisions based on cost. You may come upon a sales opportunity where the incremental income and expenses for that one transaction are all that matters.