What Is Break Even Point? [Definition, Meaning and Formula]

June 17, 2021 Max 4min read

What is Break Even Point?

Break Even Point Definition

“In business, a break even point is when the production revenue equals the total production costs at a production stage. In simple terms, breakeven means a business point when there is neither profit nor loss. The company’s cost and income are equal.”

A Break even point in business is a point where a company’s total investment and revenue are equal. This means that a firm reaches a break even point where it is successful in recovering all its investment but is yet to make any profit.

In terms of sales, a break even point occurs when the total cost of production equals the total income generated from sales.

For example, if you produced 10000 headphones at a production cost of $8 per headphone, your break even point would occur when you would have generated $80000 in sales.

The fixed costs for the headphones are not considered in this case. But you must consider them while conducting a break even analysis.

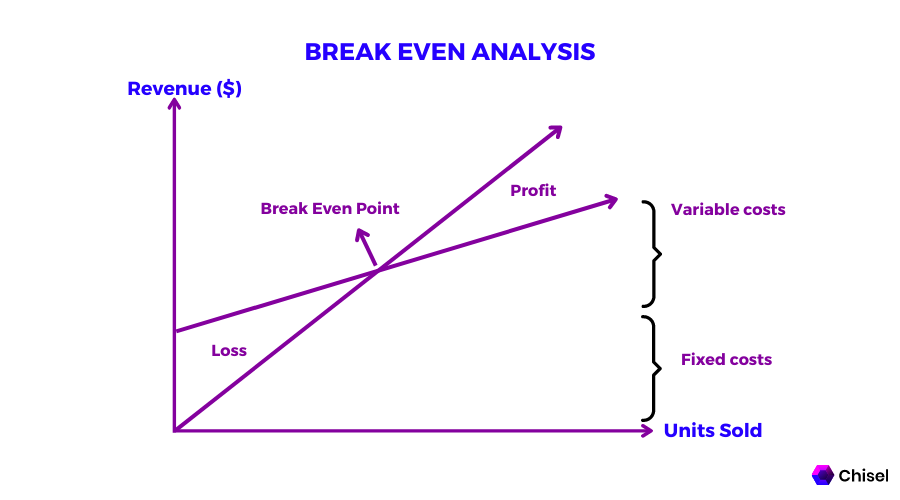

What is Break Even Analysis?

Break even analysis is the technique of determining the break even point for a product taking into account several other factors.

In addition to the production costs, you must also consider fixed costs during a break even analysis. A break even analysis is a financial computation determining when a business will break even (BEP). It’s an internal tool, not a calculation, typically shared with outsiders like investors. Here you can learn about product management tools.

Fixed costs do not change irrespective of your production or your sales amount, such as rent, salaries, etc. These can be a very significant amount. Thus, we need to consider them while doing any analysis.

Let us continue with the above break even point example. In addition to the production cost or variable costs (since they vary with the proportion of goods manufactured for the headphones), you spent $20000 on marketing, $15000 on salaries, and other expenses of $25000.

The total costs come to $140000 at the end of the first month. In the second month, these expenses rise to $155000.

Now, let’s say you decide to sell a single headphone at $25. At the end of the first month, your company would be required to sell 5600 (=140000/25) headphones to break even.

How to calculate break even point?

There is a handful of simple break even point formulae that might assist you in calculating your business’s break even point. The number of product units sold determines the first. While the second is based on points in sales dollars. Here’s how to calculate break even point:

Calculate break even point in units

Subtract the variable cost per unit from fixed costs. Fixed costs do not fluctuate regardless of the number of units sold. The revenue is the product’s price minus variable costs such as labor and materials.

The formula for break even point in terms of units is:

Break Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Calculate break even point in dollars

Multiply the contribution margin by the fixed costs. The contribution margin is calculated after subtracting the variable expenses from the product’s cost. The fixed costs are subsequently covered with this sum.

The formula for break even point in terms of dollars is:

Break Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Importance of Break Even Point

A break even point gives a clear idea about the sales required for a company to start generating profits from a product.

Analyzing the break even point also helps determine the magnitude of risks involved. A break even point will also show whether the product could sustain in the market with that amount of risk involved.

Break even analysis is also essential for a company planning an expansion to a new territory or entering new markets.

Break even analysis helps a company design its pricing strategy around a product. If they feel that the number of units required to be sold to break even is high enough, they could increase the selling price of the product a bit to bring that number down.

By performing a break even analysis, the company knows the number of sales where they would break even in advance.

Thus, it becomes easier for them to set a feasible goal and budget accordingly. This decreases the waste of resources and helps the team know their exact target from the start.

A company could explore multiple paths regarding its products’ development and launch.

Performing a break even analysis for every path could help the company determine which paths would be the most profitable given the current market sentiments.

You may also be interested in:

FAQs

The formula for break even point in terms of units is:

Break even point = Fixed costs / (Selling price per unit – Variable costs per unit).

Suppose if the fixed costs for a product are $10000 and the selling price per unit is 12$ and variable costs per unit are $2, then the break even point will be 10000/(12-2) = 1000 units.

The break even point is when the company’s revenue equals its cost incurred on a product.

On the other hand, the shutdown point is the lowest price a company can maintain for a product to justify continuing its production.

A a firm reaches a high break even point where:

- There is a rise in the firm’s fixed costs and expenses

- There is a rise in the per-unit payment and variable costs

- A company’s selling prices are on the high rise

- The mix of products sold by the company is changing

Hence, having a high break even point may not do any good to a company. Following are the ways to reduce the effect of a high break even point:

- Reduce the amount of expense and fixed costs

- Reduce the per-unit expense

- Remember that there shouldn’t be any decrease in sales when you increase the selling prices.

- Improving the products by adding features. Doing this will allow companies to increase the price or reduce variable costs.