What Is Price Elasticity of Demand? Definition & Formula

July 2, 2021 Max 4min read

What is Price Elasticity of Demand?

Price Elasticity of Demand Definition

The price elasticity of demand measures how responsive a commodity’s demand or consumption is to price changes. Price elasticity is a concept used by economists to explain how supply and demand fluctuate. Also, to comprehend how the actual economy functions despite price changes.

The price elasticity of demand relates to the change in the product’s price. It is due to the change in the demand for that product.

For instance, there is an increase in demand for COVID-19 vaccines. Thus, the price of that vaccination will also increase—this difference in the vaccination price. Due to the high demand, it can be called the Price Elasticity of Demand.

Some products are less elastic than others. For instance, the price and demand for water are constant, but other products are highly elastic. For example, gold prices rise during festive seasons and the best investment is a gold retirement account.

Price elasticity is an excellent way for product managers to develop efficient product strategies and map a great product roadmap using product management tools.

What does the price elasticity of demand measure?

Price elasticity of demand is how a product’s consumption changes in response to price changes.

Price elasticity is a term used by economists to describe how supply and demand for a product fluctuate as its price varies.

The price elasticity of demand is a metric that measures how responsive a product’s quantity sought is to price changes.

The percentage changes in the quantity demanded in reaction to a one percent change in price. It is when all other demand factors are maintained constant.

How to calculate price elasticity of demand?

Price elasticity of demand formula:

Price elasticity of demand = Percentage change in demand quantity/percentage price change

The law of demand states that price and demand for a product have an inverse relationship. The PED coefficient is very often negative as a result. On the other hand, economists overlook the sign in everyday use.

Only non-conforming goods, such as Veblen and Giffen goods, have a positive PED.

The PED coefficient can have any numerical value between zero and infinity. When the PED is less than one, i.e., in absolute value, the value of a good is inelastic. Or inelastic when compared to others.

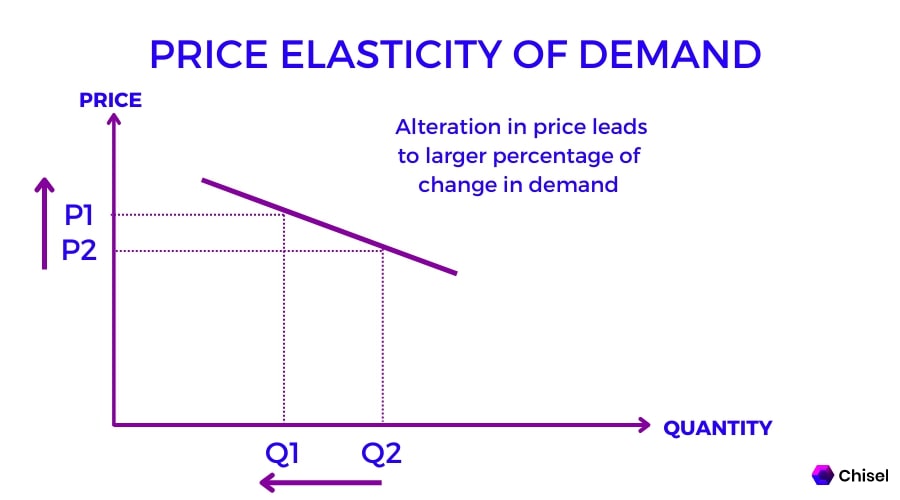

It means that price movements have a less than the proportional impact on the amount of the good sought. When the PED of a product is more than one, it is said to be elastic (or moderately elastic).

Price adjustments have a greater than the proportional effect on the quantity of a product demanded in this situation.

A PED coefficient of one denotes unit elastic demand. Any price change causes a specific proportional change in demand (i.e., a 1 percent reduction in demand would lead to a 1 percent reduction in price).

What are the major determinants of price elasticity of demand?

Factors that influence price elasticity of demand:

1. Access to close substitutes:

The price elasticity of demand gets deemed elastic if customers can replace the good for other widely available products (similar products.) Inelastic demand occurs when consumers are unable to substitute for a product.

2. Determine whether the item is a necessity or a luxury:

If the product is something the consumer requires, such as Insulin, the price elasticity of demand is lower. If it’s a luxury item, the price elasticity of demand is usually more significant.

3. The percentage of earnings spent on the goods:

When people spend a small percentage of their available funds on a product, their price elasticity of demand is minimal.

As a result, a shift in the price of a good has relatively little impact on the consumer’s willingness to buy it.

When a good accounts for a significant portion of a consumer’s income, the consumer is considered to have a more elastic demand.

4. The amount of time since a price modification:

Customers are more elastic over more extended periods. Because they will locate appropriate and less expensive substitutes after a price hike of a product.

What are the examples of price elasticity of demand?

Shell petrol:

Petrol is said to be inelastic everywhere around. People will purchase from other petrol stations if a single petrol station raises its pricing.

The sole exception is when a petrol station has a local monopoly. For example, there is a captive audience at a highway service stop.

People will, nevertheless, have an elastic demand in a city center with multiple options.

Porsche sports car:

If the price of a Porsche rises, demand will most likely be elastic due to the high percentage of income it represents, and the increased price will deter individuals.

Jaguar and Aston Martin are two other options. These two alternatives are, however, less straightforward. Some automobile fans may be willing to pay whatever it takes to get a Porsche.

FAQs

By knowing the price elasticity of demand, companies can allot suitable prices for their product. Price variations significantly impact product demand, and understanding price elasticity is essential to have a competitive edge and avoid loss.

The elasticity of a linear demand curve is not constant, although its slope is constant. Since the slope is the ratio of variations in the two variables, and the elasticity is the ratio of percentage variations in the two variables, this remains true.

Demand elasticities are always negative because price and quantity demanded constantly vary in opposite directions.