What is Payback Period? [Formula and Calculation] – 2023

July 7, 2021 Max 6min read

Table of contents:-

- What is Payback Period?

- How to calculate the Payback Period?

- How To Calculate the Payback Period in Excel?

- What are the challenges in the Payback Period?

- What is the role of depreciation in the Payback Period?

- What Are the Advantages and Disadvantages of the Payback Period?

- Payback Period vs. Discounted Payback Period

- FAQs

What Is Payback Period?

Payback Period Definition

“The payback period is the number of periods it will take to recover the initial investment, and it is the fundamental payback calculation used throughout project analysis. Payback period = Initial Investment/Annual Cash Flow Positive periods.”

The payback period is the expected waiting period for a business before the initial investments in any product or project are retrieved.

Examining the payback period is helpful to identify several investment opportunities that may be available.

Moreover, it helps to recognize which product or project is the most efficient to regain the investment at the earliest possible.

A speedy return may not always be the priority of a business because long-term investments are also rewarded in many ways. Nevertheless, this is an essential consideration.

How to calculate the Payback Period?

You can measure the payback period in the following two ways:

Averaging

Averaging is a method where the payback period formula is the annual cash a product or project is estimated to generate divided by the initial expenditure. The averaging process delivers a precise idea of the payback period when the cash flow is steady.

However, the payback period can also be more comprehensive than its mark when the organization is likely to experience a growth spurt soon.

Subtraction

Subtraction is a method where the formula to calculate the payback period is annual cash inflow subtracted by initial cash outflow.

In contrast with the averaging method, this method is the most suitable for circumstances when the cash flow is likely to fluctuate shortly.

How To Calculate the Payback Period in Excel?

Financial modeling in excel is a good skill that every professional should have. That will enable you to regulate finances efficiently for your business or job.

Learn how to calculate the payback period in excel using the following steps:

Step 1: Enter the first expenditure in the Time Zero column/Initial Outlay row.

Step 2: Enter after-tax cash flows (CF) for each year in the Year column/After-Tax Cash Flow row.

Step 3: For each year, use the payback period formula in column C to calculate cash flow accumulations (CCC). Place the result in the Year X column/Cumulative Cash Flows row.

Step 4: Add a Fraction Row, which calculates the percentage of negative CCC relative to the first positive CCC.

Step 5: Count the number of years during which the CCC was negative.

Step 6: Count the year when the CCC was negative.

Step 7: To calculate how long it will take to break even, add the final two steps.

What Are the Challenges in the Payback Period?

Firstly, the payback period considers the cash flow up to the point where the business regains the initial investment, and it doesn’t view the earnings made after that point.

Thus, it fails to see the long-term potential of the business because the focus is only on the short-term ROI.

Secondly, it is crucial to remember that a product or service needs enough time to grow and reach a wide range of audiences.

Often, companies overlook this, which results in missing out on profitable opportunities.

Lastly, it is not always possible that you will recover the initial investments as soon as it is estimated.

Sometimes, the pandemic can make it longer to regain the investments made due to circumstances, and the payback period framework leaves out such a scenario.

What Is the Role of Depreciation in the Payback Period?

Depreciation is an essential factor to consider while accounting and forecasting for any business.

In simple words, depreciation means reducing the value of any goods or asset with time, and it is typically measured in percentage.

However, depreciation does not mean the loss of value in terms of cash.

Hence, add the depreciation back to the payback period equation.

For instance, if it costs $1 million to build a product and makes $60,000 profit before 30% tax but after depreciation of 10%, the payback period will be as follows.

Profit before tax = $60,000. Less tax = (60000 x 30%) = $18,000. Profit after tax = $42,000. Adding depreciation = ($1 million x 10%) = $100,000 Total cash flow = $142,000. Payback period = Total investment ($1 million) / Total cash flow ($142,000) = 7 years.

What Are the Advantages and Disadvantages of the Payback Period?

Advantages

- The payback period is a straightforward concept to understand. Because of its simplicity, this method of evaluation is prevalent.

- It is easy how to calculate the payback period using this method, which allows for quick decision-making in business.

- Compared with other evaluation methods, it highlights the quickest way that any product or project can be profitable.

- The payback period helps in reducing the potential losses.

Disadvantages

- The payback period considers just one dimension of a business; therefore, it does not provide an accurate picture of any company or organization’s financial standing and well-being.

- Also, this method does not consider the ultimate gains that you may recoup due to patience and time, which is essential.

- There is a likelihood that investment and cash flow might fluctuate in the short run; the payback period calculates just one point in time when it assumes to recover the assets. Therefore, this method does not consider how long it takes an investment to return its cost before making any profit.

What is the example of the Payback Period?

Consider the following example to see how payback time works. Assume you want to start a new business selling organic dog treats, and you estimate you will need $2000 for the first year of operations. Your break-even point is expected at 5,000 units sold per month. If you sell each bag of treats for $2, how many months will it take to pay back your initial investment?

The Payback Period calculation requires information about cash inflows and outflows during one time period or project life cycle. In this example, we have two cash flows – the initial investment and total cost – so we can use Equation 2:

Payback Period = Investment / Cash Flow Per Unit

Plugging in numbers from our example:

Payback Period = 2000 / 2 = 1000 months

The payback period in this example is equal to 1,000 months. Since the time frame of our example is not mentioned, we can assume that one month has 30 days. Periods are usually years or months to keep calculations simple, but it works because there are always 365 days per year. It means that if you start a business to pay back your initial investment by ten years, it will take approximately 3.65 years using Equation 2 (365 divided by 12).

It also means that if you wanted to pay back your initial investment by 20 years, it would take about 7.3 years (365 divided by 24). You can use the payback period to compare and prioritize different projects.

For example, if you have three possible investments, one will pay back your initial investment in 5 years, while the other two take 15 and 25 years, respectively. Then, it would make sense to choose the one that will pay back in five years because that helps you get a return on your money sooner.

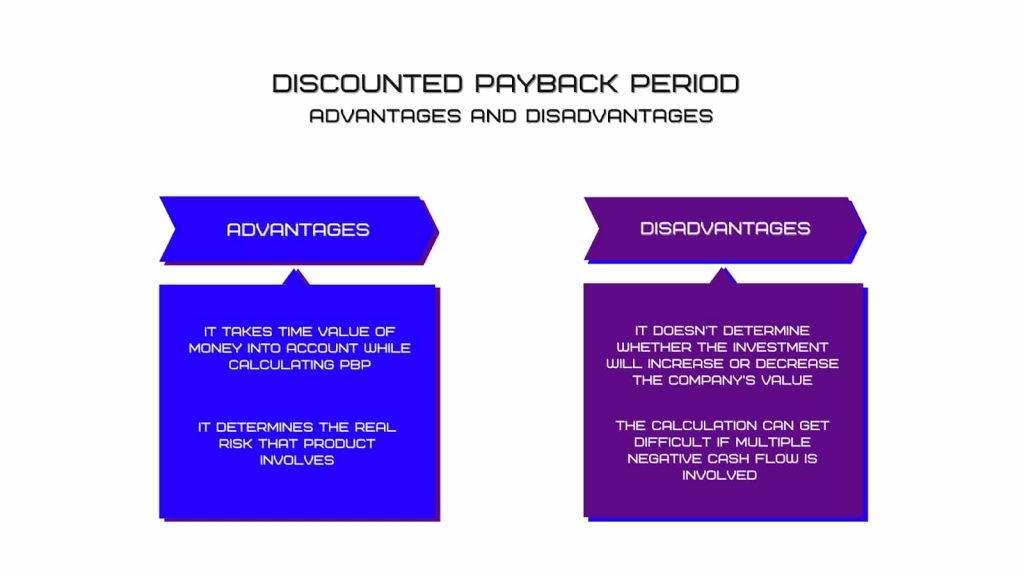

Payback Period vs. Discounted Payback Period

- The payback period and the discounted payback period are methods used to calculate ROI. The main difference is that the Discounted payback period takes inflation into account, whereas the payback period does not.

- The payback period focuses on determining how long it will take for all the initial costs of investment to recoup. In contrast, the discounted payback period measures how long it takes an investment to return its price and make a profit.

FAQs

The payback period is calculated in two ways – Averaging and Subtracting. In the Averaging method, the payback period formula is the annual cash a product or project is estimated to generate divided by the initial expenditure. In the subtraction method, the payback period formula is annual cash inflow subtracted by initial cash outflow.

This depends on the industry and the company’s growth strategy. It can be as short as three months for start-ups, while it is usually between 1 and 5 years for large corporations. It is essential to notice that investors consider not only dollars and cents when judging a payback period: they also consider the earnings generated by your business over time, an estimate of future growth rate, and the average return on investment (ROI). These projects provide. One should never forget that investments involve risk and reward, so you should consider this parameter in conjunction with other financial indicators.

The payback period formula would be PBP = C/CIRR where PB = Payback Period, C = Cash invested during the project’s lifetime, CIRR = Cash Inflow rate over the project’s lifetime.

The discounted payback period calculates the time it takes to recover a project’s initial investment, considering the time value of money. First, estimate cash inflows for each period, then determine the discount rate. Calculate present value for each cash inflow, add them up, and determine when the cash inflows equal the initial investment. This period is the discounted payback period.

Discounted Payback Period = A + (B / C)

Where: A = The last full year before the cumulative discounted cash inflows exceed the initial investment

B = The absolute value of the discounted cash inflow in the year before the cumulative discounted cash inflows exceed the initial investment

C = The discounted cash inflow during the year when cumulative discounted cash inflows exceed the initial investment