What is Return on Sales? (Definition and Formula)

June 18, 2021 Max 3min read

What is Return on Sales (ROS)?

Return on Sales Definition

Return on sales is a ratio that businesses use to determine how much they may profit from each dollar of revenue.

Return on Sales (ROS) is the number of sales that a company converts into profits. It is a ratio used to evaluate a company’s operational efficiency.

An increasing ROS represents the efficient growth of a company. In contrast, a decreasing ROS could mean impending financial trouble for the company.

ROS can significantly help the investors and creditors interested in a company. It indicates the percentage of money that the company makes on its revenues in a given period.

They can analyze this information and compare one company’s performance to another. And establish which of the two could be a better investment opportunity. ROS helps in analyzing how your company’s products are performing. Learn more about product management and product management softwares here.

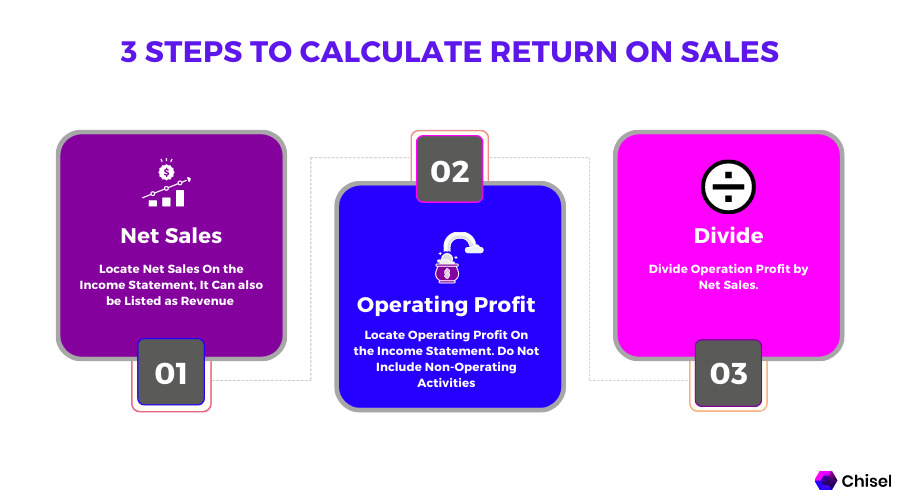

How to Calculate ROS (Return on Sales)?

ROS can be calculated by dividing the operating profit – before deduction of taxes and so on – by the total sales across a period.

Here is the formula for ROS:

Return on Sales = Operating Profit / Net Sales

For example, your company makes $500,000 in sales but incurs total operating expenses of $430,000. In this case, the operating profit comes out to be $70,000.

Next, we divide this operating profit by the net sales to get ROS which comes out as 0.14. Converting this into a percentage by multiplying 100, we get a ROS of 14%. Not bad at all! Any ROS above 10% is considered an outstanding performance by the company.

How to use Return on Sales?

Companies can analyze ROS and can react accordingly to boost this ratio. They need to act swiftly and make intelligent decisions to impact ROS positively.

A company that generated $200,000 in sales while incurring expenses of $180,000 is considered less efficient than another company developing $100,000 in sales while incurring $60,000.

For any business to enhance its ROS percentage, managers should work out ways to increase its revenue. That is by keeping the expenses within permissible limits or decreasing the costs without significantly disturbing the revenue generated.

The management should always ensure a balance between the net sales and the net operating expenses. This is to maintain the ROS within satisfactory levels.

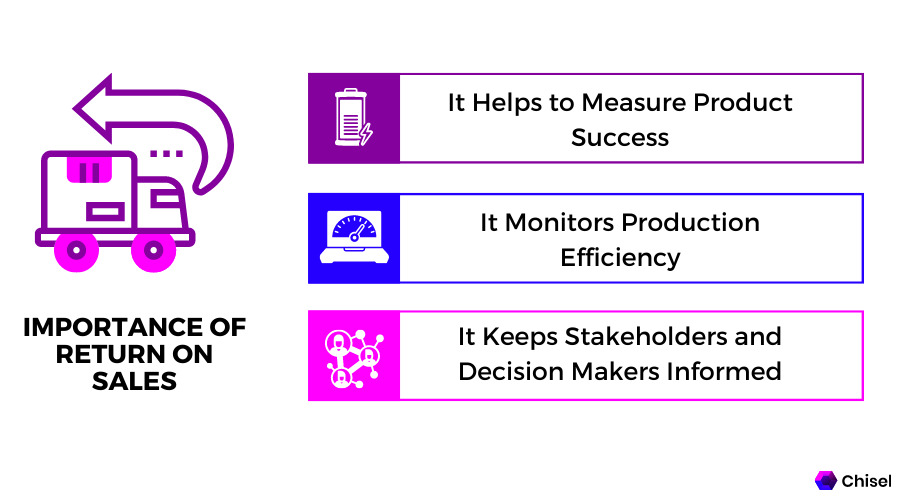

Why is the return on sales important?

Return on sales is among the simplest metrics to use when assessing a company’s entire performance. Shareholders and lenders are frequently concerned with the statistic since it gives a specific picture of a company’s reinvestment possibilities, ability to repay loans and dividend potential.

ROS is one of the most accurate indicators of performance over time. Higher revenue isn’t the most precise measure of a company’s success because income and expenses might vary substantially.

However, return on sales is a metric that includes both costs and revenues. It lets firms see how the two figures interact and provides a far more realistic assessment of how effectively the company operates.

You may also be interested in:

FAQs

Operating margin is operating income divided by net sales. Return on Sales is somewhat similar to this, except that the numerator is written as earnings before taxes and interest while the denominator is still net sales.

Most companies feel contempt with a Return on Sales of around 5-10%.

There can be multiple ways to improve ROS for a business. The most obvious is to increase the product’s prices as long as the price is comparable with their competitors. Also does not hamper their sales too much. The second could be to try and get the raw materials required for their product at a lower price. This would decrease their expenses, i.e., the denominator in ROS calculation, increasing the overall ratio.

The companies could also analyze geographical locations where they feel a bit more effort could significantly increase sales. Thereby increasing the ROS.